Analysis: InsurTech & Insurance Websites vs Top UK Sites

Have you ever wondered how your website compares to the Internet as a whole?

Many of us have used a tool like Google’s Page Speed Insights to assess our website’s strengths and weaknesses. Have you ever wondered how your website compares to the Internet as a whole? More importantly, how do you stack up against the websites in the sector you’re competing in?

With our recent foray into working with more businesses in the InsurTech market, I was curious about how the Insurance sector stacks up against the top websites in the UK. So, I did the only thing that someone with a little programming knowledge and curiosity can do – I built a tool to help me find out.

I’ve taken a list of Insurance websites (both traditional and InsurTech, from our own lists), and a list of top UK websites (from Alexa) and run them all through the Google PageSpeed Insights API. I stored all the results from individual websites, and we’ll go through the results in a moment. As a bonus, at the end there’s a download of all the data for you to look through in case your own site is in there.

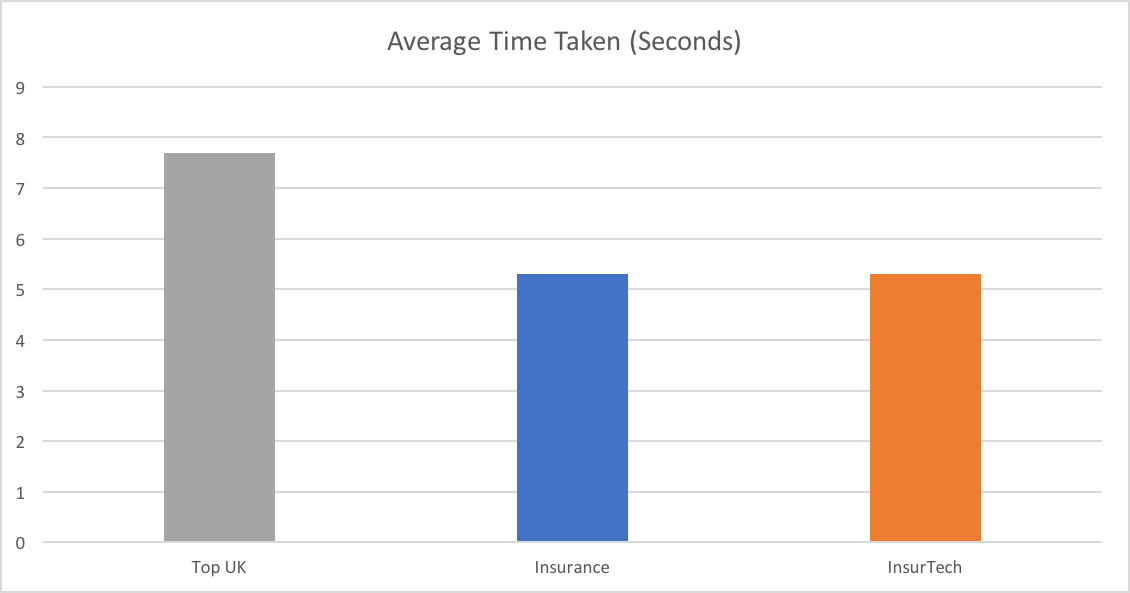

Time Taken to Get Result

This is a measure of the time it took Google PageSpeed to do the same calculations that it does in the web interface, and which are detailed below. It’s not directly representative of page load time, but I would imagine the correlation is close. You can see that Insurance sites were much faster to get results from, possibly showing that Insurance websites load faster than the top UK sites. The faster a page loads, the more likely we are to see both better engagement rates with users and increased organic search traffic. InsurTech sites come in at exactly the same level here.

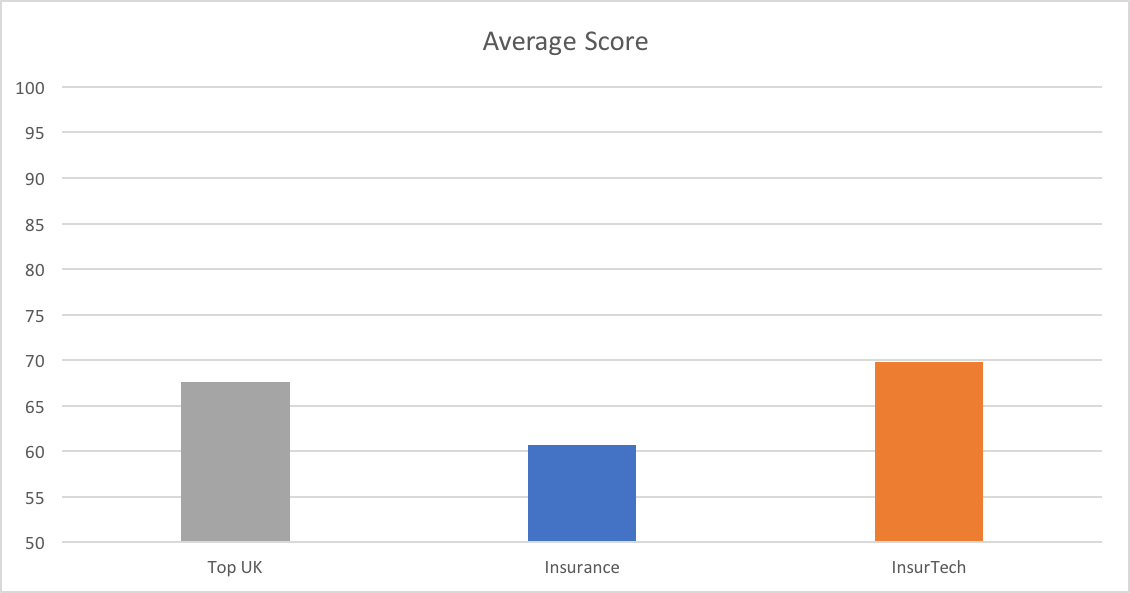

Average Page Score

This shows the average overall page score given by the PageSpeed tool, which is top level summary metric combining the results of all the insights below. It is scored from 0 to 100, with 100 being the best possible result. We see that the Insurance market gets a lower average score of 61 vs 68. InsurTech, however, gets the best overall score of the test with nearly 70.

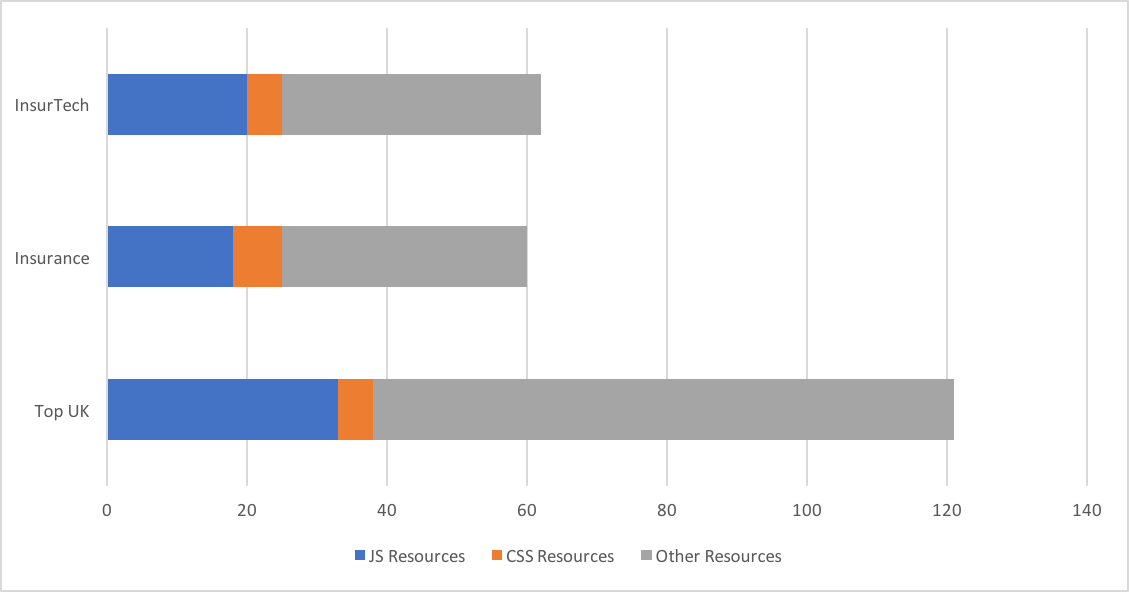

Number and Type of Resources

This graph shows us the overall number of resources taken to load a website. These include the main page HTML itself, as well as any images, Javascript and CSS. Each resource takes time to request and load from the server, which is the reason for such a strong correlation between these results and the earlier ‘Time Taken’ results. The average top UK site, for instance, loads just over 120 resources to render the home page, while the Insurance sector loads around half as many. That’s half as many round trips between your visitors computer and the server your site is hosted on.

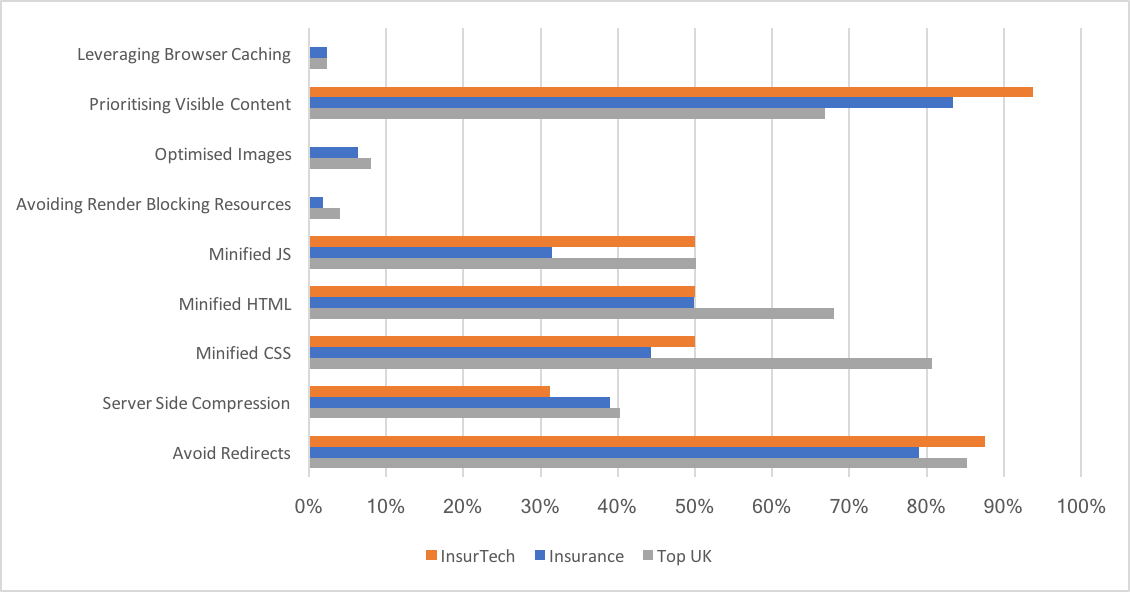

Other Scoring Factors

This graph shows the percentage of websites in each data set which ‘tick the box’ for each of the metrics. To achieve an overall PageSpeed score of 100, your site needs to succeed in each of these areas. A site with a perfect score will leverage browser caching, optimise their images, minify their HTML, etc.

We can see that the Insurance sector only wins out against the Top UK sites in one area: Prioritising Visible Content. Everywhere else the sector is behind, especially in areas like minifying resources to save overall page load size. InsurTech fares slightly better in minifying Javascript files and avoiding redirects, but the sector is failing miserably when it comes to blocking rendering resources, optimising images and leveraging browser caching. This result surprised me – I expected the more tech-focussed subsection of the industry to fare far better in the technical tests.

I find it especially interesting that all three sets of data are struggling with Browser Caching, Optimising Images and Avoiding Render Blocking Resources. Optimisation of images, especially, should be high on the list of any site looking to make an improvement in page speed.

If you’d like to have a look at all three of these data sets, you can download them below. If you’d like to see this analysis for other sectors, get in touch below and let me know.

Download the full data here

Author

Jason Dilworth

Jason rolls together knowledge of programming, automation and data analysis to provide a high level of technical marketing expertise to The Marketing Eye and its clients.

Technical Director / The Marketing Eye

Related Reading

Blog: Navigating the New Email Marketing Standards: What You Need to Know

by Darren Coleshill, 3 minute read

Blog: Crafting Captivating Email Newsletters: A Guide to Success

by Darren Coleshill, 4 minute read