BBB small business finance markets report 2017-18

The 80+ pages of the British Business Bank report titled Small Business Markets 2017/18 contains a wealth of market information, including market segment statistics which are more up-to-date than those published by CCAF in December. For example, the UK’s SME population is now said to stand at 5.7m and accounts for at least 99% of the businesses in every main industry sector and region.

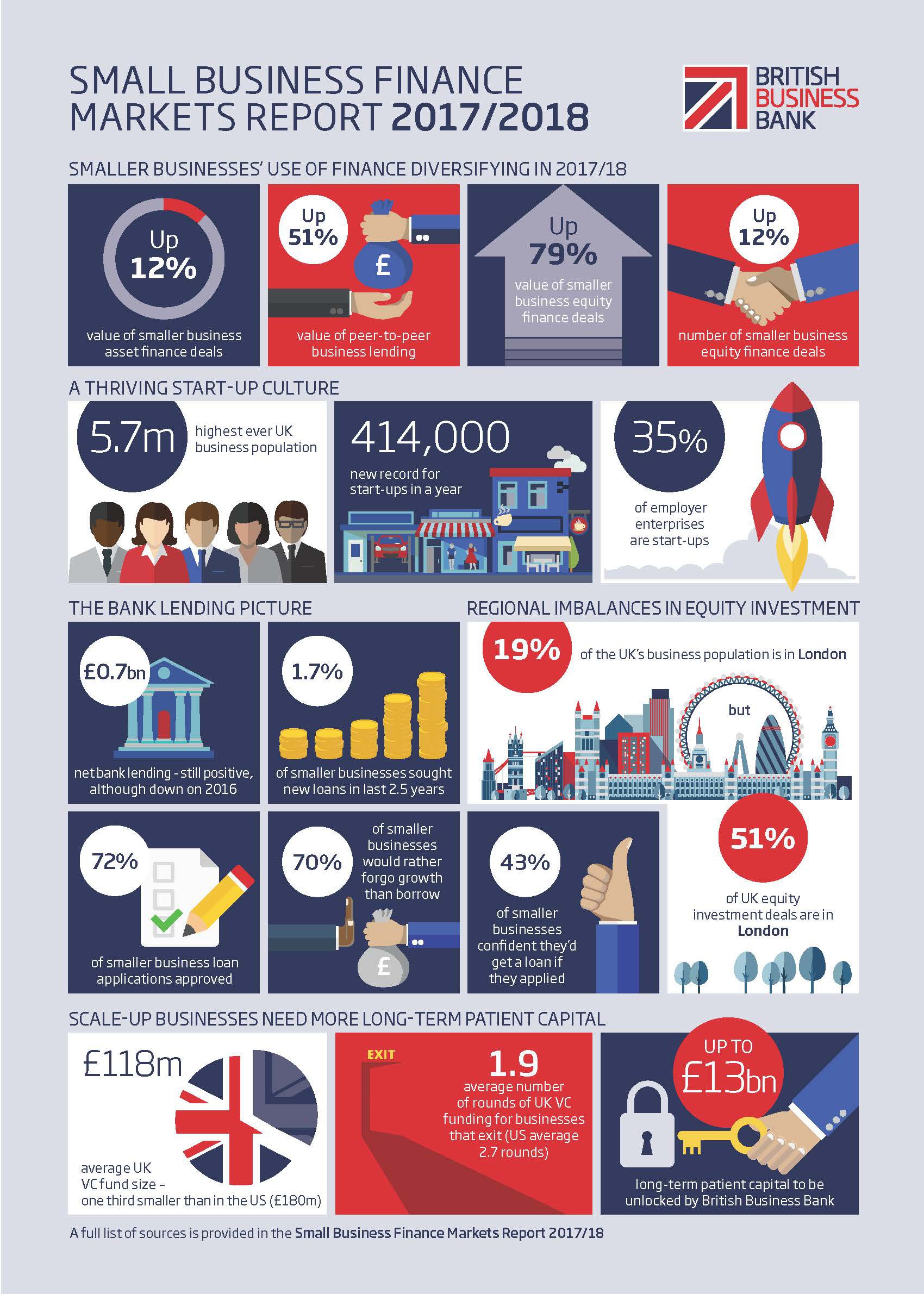

The broad headline stats for 2017 are that P2P lending grew by over 50%, asset-based lending grew by 12% and equity investment in SMEs went up by 80%. The report acknowledges that P2P lending is challenging bank lending, but for perspective, points out that, for all its apparent growth, P2P still represents only 3% of the market.

The report also confirms that there has been a general fall in loan applications from SMEs, many preferring to live within their means rather than borrow to grow. Conversely, the amount of cash that SMEs have on deposit has grown; in Q2 2017, 26% of SMEs reported holding more than £10k in credit balances, an increase from 16% in 2012 and 21% the same time last year – new debt applications for loans and overdrafts have been falling since 2012. We knew the trend, but the BBB report gives us the numbers.

The BBB report also confirms that younger companies looking to grow still have trouble finding the bank finance they require, largely because they lack an historical track record or the assets against which debt can be secured; banks therefore frequently turn down loan applications from high growth firms because their financing needs are less routine and more likely to be complex. And, even though equity finance may be the obvious answer to the problem, many business owners don’t want to dilute their shareholding for fear of losing control. An exaggerated fear of rejection also prevents them seeking external finance of any kind. The report states that “For many UK SMEs, their ultimate aspiration is to be debt free. In 2016, 68% of smaller businesses agreed that their aim ‘was to pay down debt and remain free if possible’. 81% of smaller businesses in Q2 2017 agreed that ‘our current plans for the business are based entirely on what we can afford to fund ourselves'. Around a third of SMEs use external finance, while a half fall into the category of ‘Permanent non-borrowers’.

The knock-on effect of this attitude is that productivity remains low, restricting growth in the economy.

On page 19, the report refers to demand-side market failures and argues that “Entrepreneurs must be convinced that it is preferable to own a smaller share of a larger, more valuable entity with the additional finance, support and expertise this could provide, than it is to remain in sole control of a smaller, less valuable business.”

The BBB is intending to address the issue by providing information through a digital hub, which it will launch later this year.

The report also discusses Open Banking, the role of the challenger banks and other market trends – there’s something of interest for everyone, depending on your taste. A copy of the report can be found here.

Author

Neil Edwards

Neil is a Chartered Marketer and Fellow of the Chartered Institute of Marketing with many years' experience in marketing, brand and communications.

CEO / The Marketing Eye

Related Reading

Blog: Whatever happened to RateSetter?

by Neil Edwards, 4 minute read

Blog: The Real Cost of Investing with St James's Place

by Neil Edwards, 3 minute read