A target isn’t a forecast - don’t confuse the two

As marketing teams and finance teams put the finishing touches to their plans for the new financial year, a common problem lies in wait.I read a book recently by Dr. Steve Morlidge of the Beyond Budgeting Institute. Called The Little Book of Operational Forecasting, it lays out, in layman’s terms, the difference between a target and a forecast.

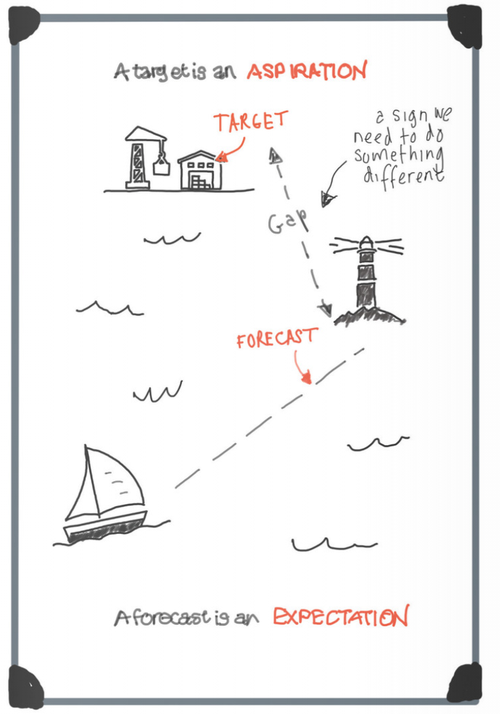

"A target is an aspiration, a forecast is an expectation", he says. Brilliant.

How many times do we, as marketers, see the two conflated and find ourselves the unwitting victims of unrealistic expectations?

“A target is an aspiration, a forecast is an expectation”

I’ve seen this play out many times in my career. A case in point is a very recent engagement.

Our client had entered into a new business partnership. Enthusiasm was high and there were high-fives all round for getting the deal over the line. And rightly so - it was a bold and groundbreaking agreement. An equally bold number had been put into the financial plan in anticipation of what this new partnership could deliver.

As attention turned to marketing, we were engaged to do some modelling to support the targeting strategy. A first step in the process was to quantify the total opportunity and how it was distributed around the country. We approached the forecast in three different ways: market share, propensity to buy, and historic performance. Each time we arrived at a figure that was approximately one third of the financial plan.

Clearly, something must be wrong and we were sent back to look at it again. We came back with the same answer.

So now the business had a dilemma. Does the financial plan need to change or is something different needed to meet the plan?

Boards are normally reluctant to change financial plans. Promises have been made to shareholders and budgets are geared to generating a certain level of revenue. The result is the problem is pushed back down to the sales and marketing teams.

Now, there is no problem, in principle, with having a target in excess of a forecast. A stretch can be motivating and can drive innovation. The important point is that it is understood and accepted, from the board downwards, to be a stretch target and that financial and human resources are going to be needed to achieve it: more marketing budget, a greater proportion of the sales resource focused on the opportunity, an investment in training, more senior management focus.

The forecast should happen. The target needs to be made to happen.

If applying resource to the opportunity isn’t going to be enough to fill the planning gap, the difference needs to be made up elsewhere in the business. Perhaps another new channel has to be identified. These are difficult conversations, but they need to be had.

The consequence of not responding to the gap and just leaving it to the operational teams to work out, is the realistic possibility of failure. Beyond the immediate financial implications of a budget shortfall, failure is damaging to morale. Stress levels rise and good people end up leaving, all because the target was never realistically achievable in the first place.

The moral is, don’t let this happen in your business. Have honest conversations early on and at every level. Your business will be better for it in the end.

Here at The Marketing Eye, we have developed significant expertise in data-driven opportunity modelling. Please talk to us if you think we can help.

A big note of thanks to Dr. Steve Morlidge for authoring the book which inspired this post. You can buy a copy here. I highly recommend it.

Author

Neil Edwards

Neil is a Chartered Marketer and Fellow of the Chartered Institute of Marketing with many years' experience in marketing, brand and communications.

CEO / The Marketing Eye

Related Reading

Blog: How to Stop Your Email Newsletters from Going to Spam

by Darren Coleshill, 5 minute read

Blog: Why Custom URLs Are Essential for Your Business

by Darren Coleshill, 3 minute read